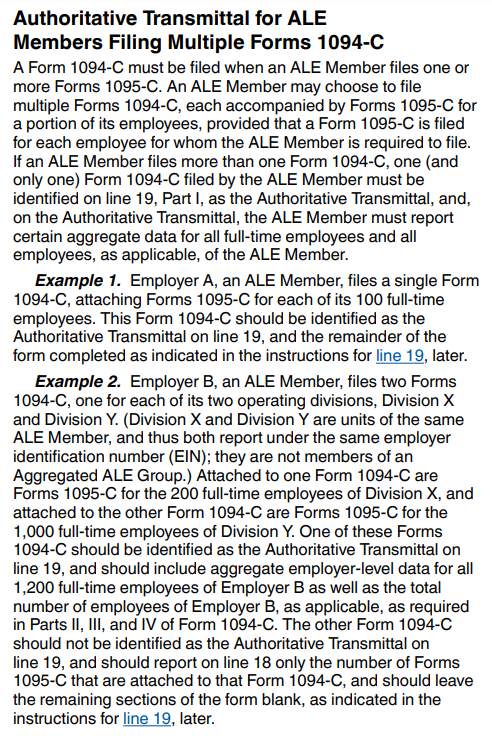

No. It’s allowed, but definitely not required. An employer can send the 1095Cs to the IRS in batch. Each batch of 1095Cs must be accompanied by a 1094C and it needs to be noted on the 1094C how many 1095Cs are being submitted at the time and how many in total will be submitted. Also, one (and only one) of the 1094Cs must be marked as the authoritative transmittal.

The below text is from the 2023 IRS Instruction Booklet for forms 1094 and 1095.